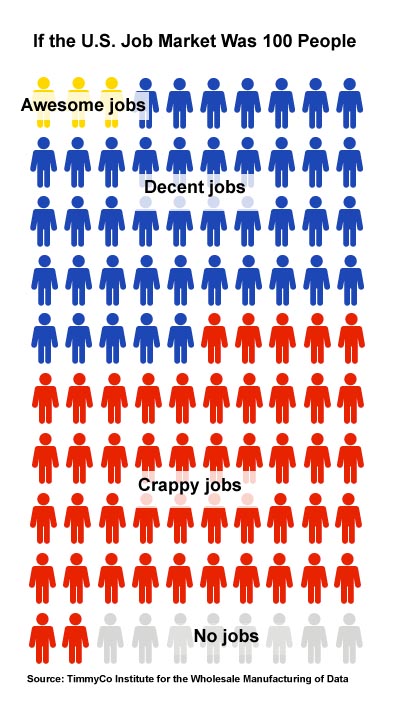

CEOS get a bad name because they have to do some unpleasant thing in order to goose up share price. Many people find layoffs, outsourcing, and union-busting to be distasteful, but these actions are necessary in order for executive management to continue receiving hefty bonuses from the board.

Speaking for most CEOS, we’d love to have both our giant compensation packages AND good-paying jobs for American workers. But frankly, our proverbial hands are tied by the real bad guys: consumers.

That’s right! The American consumer are really who is to blame for all the ills that have befallen the American worker. By now, they know how Walmart uses part-time scheduling, long-term temping, and overseas manufacturing to keep prices low. Does that keep consumers from shopping there? Of course not. Walmart is the nation’s largest retailer, and in the holiday buying season, most people talk about their great deals on flat-panel television sets rather than their terrible treatment of employees.

Walmart will say that they pass these savings on to customers, but since Walmart customers come from the same working class as Walmart employees, any costs savings passed on to the customers are essentially chipped off the take-home pay of the workers. In the best-case scenario, this would result in a break-even position. Once you factor in outsourcing that rewards customers a little and penalizes workers a lot, and the cut executive management takes out of every transaction, it’s easy to see that the better consumers do, the worse they actually do when their advantages are gained at the expense of workers.

If consumers ever figured this out, they could easily change their buying habits and shop at retailers that offer employees living wages and reasonable benefits. A little bit extra from consumers could actually help employees a lot, which in turn, means more money in the pockets of working class families, which would mean more money in circulation among the businesses frequented by working class families, which would mean more decent jobs for working class families.

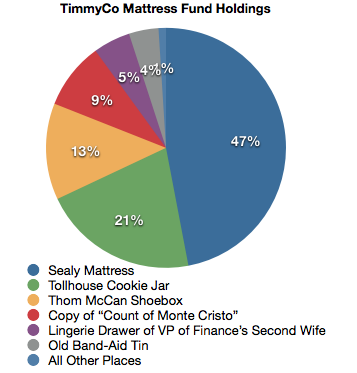

While TimmyCo generally opposes better treatment of their employees, we can see the benefits of raising prices and passing those benefits on to employees. Theoretically, better pay might actually help us keep workers that are any good. That is, if we ever were willing to pay to get a good worker in in the first place. We just know it is never going to happen. Consumers are so easily seduced by the best deal, if we don’t raid our employees’ piggie banks in order to give our customers the lowest prices, we know our competitors will.

“But, yes, I’m happy to help you.”

So heartless are consumers that we can get them to shop at our stores just by telling them how mean we are to our employees. If they see us laying off union activists or making employees work holiday hours or cutting hours to avoid paying benefits, they naturally assume that our prices are lower. The great thing is that we don’t actually have to pay offer the lowest price. Customers will come to TimmyCo stores expecting the lowest price, even when independent businesses are offering the same price. When this happens, it’s our favorite scenario: consumers pay more, employees get less, and executives and shareholders rake in the profits.

“We call this a lose-lose-win, and it is ideal,” a spokesperson for TimmyCo stated. “Consumers lose, employees lose, but management wins. It happens more than you think.”

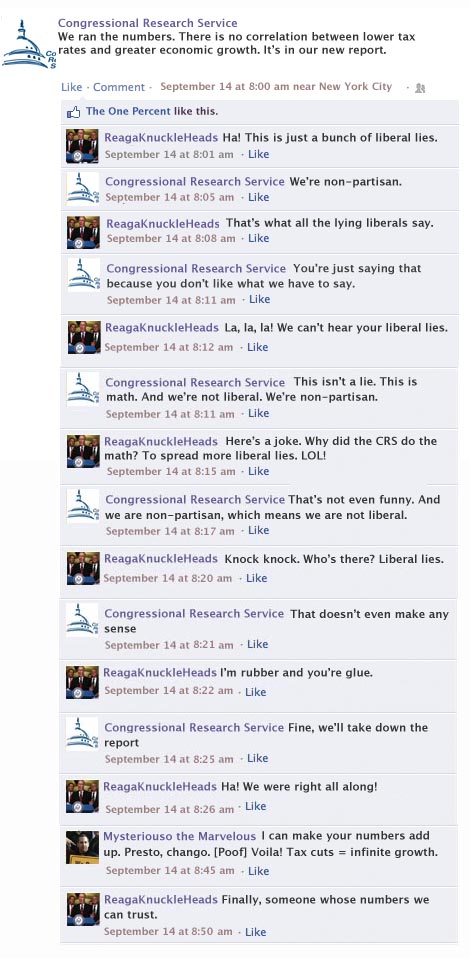

Those You Can Trust:

There’s no reason for us to hire you full-time if we can hire you as a temp.

At least in retail, consumers want you to have jobs. Other fields aren’t so lucky.

In an anecdotal story, this summer an executive at TimmyCo went to two stores to buy a car seat. The big box store and the independent store sold the same car seat. You’ll never guess which one was cheaper? The independent store even had their associate show him how to install the seat in his own car. A TimmyCo employee would never be willing to do that.

Those You Cannot Trust:

Marketplace has a series of stories on Walmart employees. In this one, warehouse workers are hired as “permatemps” to prevent them from getting benefits. These workers don’t actually work for Walmart but a contractor, insulating Walmart from the bad PR.

In this Marketplace story, a part-time worker at Walmart looking for full-time work only makes $12,000 a year. Where does he shop? Walmart.

When consumers win, both them and employees lose. What if employees win? If retailers raised wages to $25,000 a year, it could only cost consumers 16-18 cents per shopping trip. But we’re confident people won’t read this. It’s too long and written to sound “sciency.”

If we pay so terrible, how do we find these workers? Today’s low-wage workers beget the next generation of low-wage workers.

This is an old story, but instructional of how Walmart’s pressure to keep prices low forced manufacturing jobs overseas in the late ’90s and early 2000s. After the Great Recession, people blamed manufacturers, management, and politicians for the job losses, but it was the consumer who did it.

Walmart isn’t just bad for employees, it’s bad for communities. Seems that consumer dollars get reallocated to poorly paid Walmart employees from better paid employees at other retailers. These workers either lose their jobs or are forced to take pay cuts for their employers to remain competitive.